New Irs Tax Brackets 2025 Vs 2025 - Tax Brackets 2025 What I Need To Know. Jinny Lurline, New irs tax brackets take effect in 2025, meaning your paycheck could be bigger next year. The rebound in 2025's average refund size is due to the irs' adjustment of many tax provisions for inflation. The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2023 tax year (the taxes you file in april 2025) and the.

Tax Brackets 2025 What I Need To Know. Jinny Lurline, New irs tax brackets take effect in 2025, meaning your paycheck could be bigger next year. The rebound in 2025's average refund size is due to the irs' adjustment of many tax provisions for inflation.

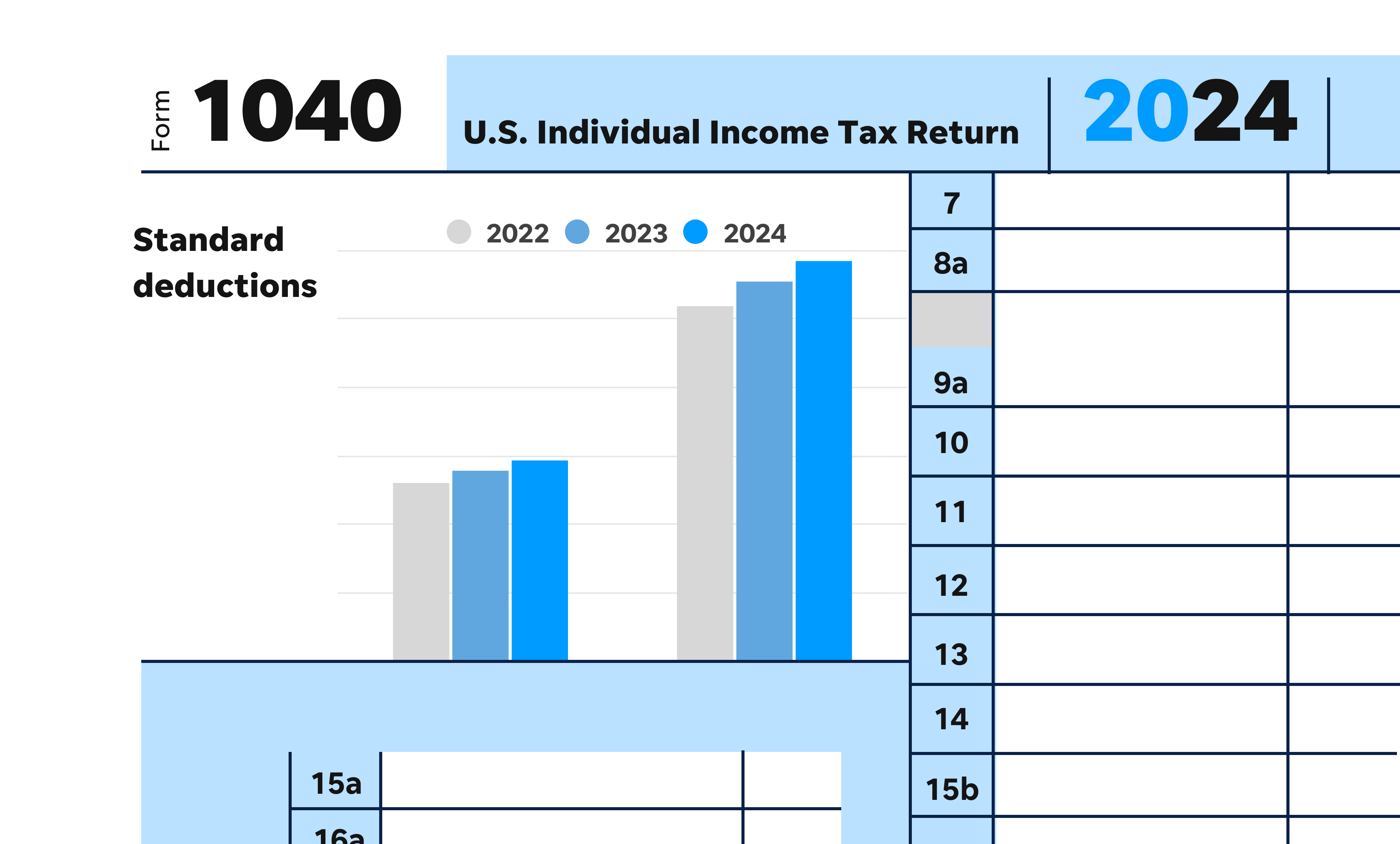

New Federal Tax Brackets for 2023, The adjustment of irs provisions for inflation for the 2023 tax year, including increases in the standard deduction and tax brackets by about 7%, has contributed to the larger. See the tax rates for the 2025 tax year.

New Irs Tax Brackets 2025 Vs 2025. The irs issued a press release describing the 2025 tax year adjustments that will apply to income tax. The adjustment of irs provisions for inflation for the 2023 tax year, including increases in the standard deduction and tax brackets by about 7%, has contributed to the larger.

IRS announces new tax brackets for 2025. What does that mean for you?, The irs announced the higher limits in november, which. See the tax rates for the 2025 tax year.

See current federal tax brackets and rates based on your income and filing status.

Here are the federal tax brackets for 2023 Axios NEWS DEMO, The irs has announced new income tax brackets for 2025. See the tax rates for the 2025 tax year.

Maximize Your Paycheck Understanding FICA Tax in 2025, The irs issued a press release describing the 2025 tax year adjustments that will apply to income tax. Along with higher standard deduction amounts, the irs has adjusted the income tax brackets from the 2025 tax year.

Irs Tax Brackets 2025 Single Sukey Engracia, November 10, 2023 / 4:59 pm est / moneywatch. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Listed here are the federal tax brackets for 2023 vs. 2025 FinaPress, 10%, 12%, 22%, 24%, 32%, 35% and 37%. Along with higher standard deduction amounts, the irs has adjusted the income tax brackets from the 2025 tax year.

There are seven federal income tax rates and brackets in 2023 and 2025:

Tax rates for the 2025 year of assessment Just One Lap, Along with higher standard deduction amounts, the irs has adjusted the income tax brackets from the 2025 tax year. In addition to adjusting the tax brackets, the irs also announced changes to the standard deductions for 2025.